Portfolio Tools

Portfolio Investment:

Enter Total Portfolio Investment:

Portfolio Calculator Instructions:

Portfolio Investment:

- Enter dollar value of total investments.

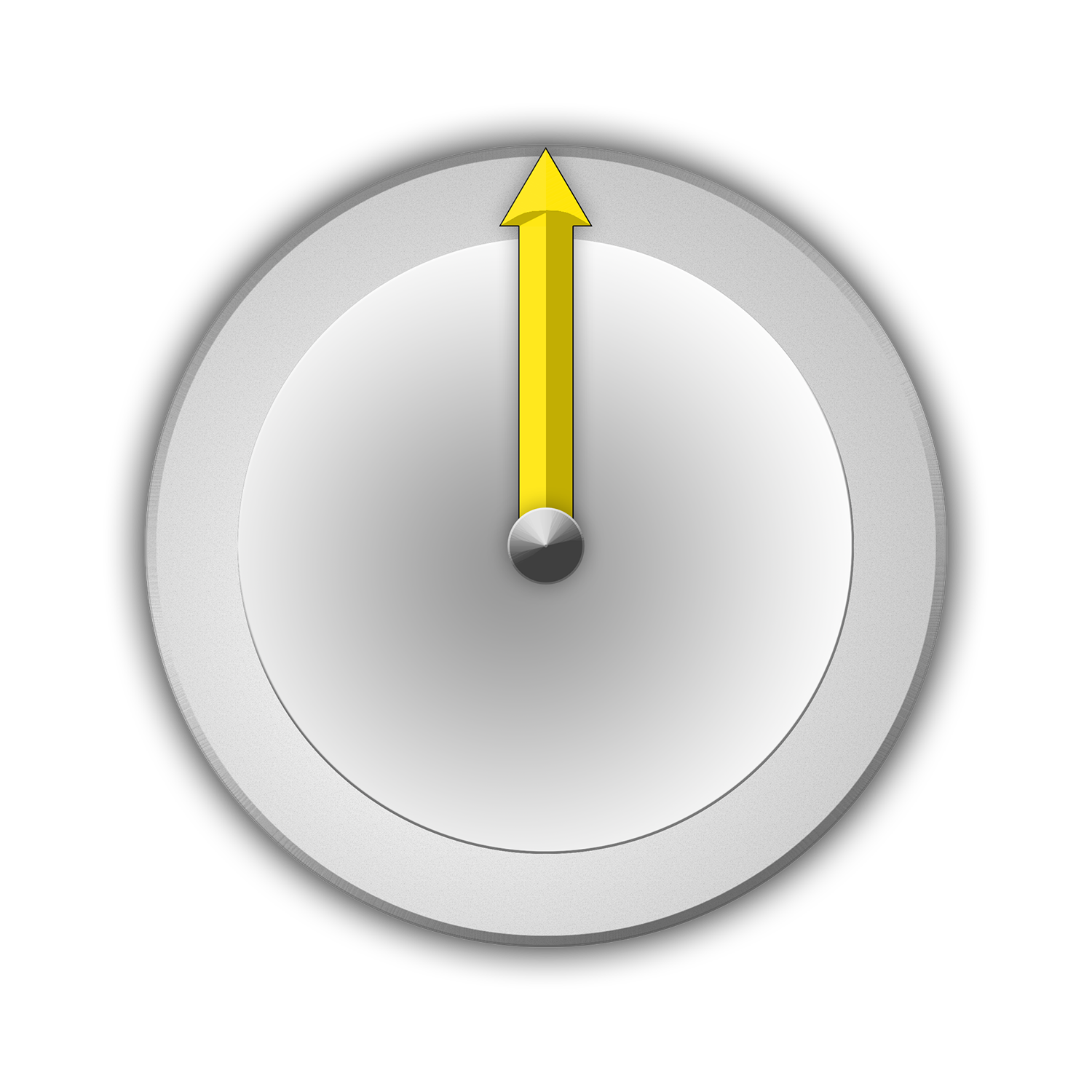

IDIV/XDIV Exposure Dial:

- Adjust

Arrow to change the combination of IDIV’s Dividend Cash Flow Exposure and XDIV’s Equity Price Exposure.

Arrow to change the combination of IDIV’s Dividend Cash Flow Exposure and XDIV’s Equity Price Exposure. - Calculator outputs provides the IDIV/XDIV potential exposure compared to what might be expected from a similar investment in the underlying index.

Portfolio Allocation

- IDIV & XDIV dollar allocations and shares.4

IDIV/XDIV Exposure Dial:

Adjust Arrow to Change Investment in IDIV & XDIV

Investment Dollars

IDIV: 34%

XDIV: 66%

1.63x

Dividend

Cash Flow1

vs Index

0.84x

Stock Price Exposure2

vs Index

Portfolio Allocation:

IDIV:

$33,991

Shares

XDIV:

$65,959

Shares

The calculator does not take into account any costs (such as commissions, taxes and account fees) borne by the investor. Such costs would increase the cost of investing.

Note: Index Equivalent Basket assumes a ratio of approximately 10.1% IDIV & 89.9% XDIV which most closely replicates the equity market's dividend cash flow and equity price exposure.

The Portfolio Calculator is an interactive tool designed to help investors customize a portfolio to their unique, target exposure to equity index price movements and dividend cash flow. Investors input their initial portfolio investment amount and then select their desired portfolio allocations.

The calculator determines the IDIV’s Dividend Cash Flow Exposure1 relative to a similar sized investment in the underlying equity index, as well as the number of IDIV shares and investment dollars needed. Similarly, XDIV’s Equity Price Exposure2 relative to a similar sized investment in the underlying equity index is calculated. Holding an equal ratio of IDIV & XDIV securities approximately represents an investment in the underlying index. This combination is depicted on the calculator as the Index Equivalent Basket3.

1 IDIV: Dividend Cash Flow Exposure percentage is the estimated percentage of dividend cash flow that IDIV investors may anticipate receiving relative to a similar sized initial dollar investment in the Index Equivalent Basket. IDIV seeks to provide the dividend cash flow and is not the yield on the investment. IDIV is the U.S. Equity Cumulative Dividend Fund – Series 2027

2 XDIV: Stock Price Exposure Percentage is the estimated percentage of equity price return that XDIV investors may anticipate relative to a similar initial investment in the underlying equity index. XDIV is the U.S. Equity Ex Dividend Fund – Series 2027

3 Index Equivalent Basket represents the combination of IDIV and XDIV shares that seeks to most closely replicate the dividend cash flow and equity price exposure of the overall equity market.

4 Estimated number of IDIV and XDIV shares that could be held in combination that seek to achieve the desired target results. IDIV and XDIV shares trade separately on the NYSE and can be held in any combination.

The tool is provided on an "as-is" basis. Metaurus Advisors LLC expressly disclaims all warranties, express or implied, statutory or otherwise with respect to the tool (and any results obtained from its use) including, without limitation, all warranties or merchantability, fitness for a particular purpose or use, accuracy, completeness, originality and/or non-infringement. In no event shall Metaurus Advisors LLC have any liability for any claims, damages, obligations, liabilities or losses relating to the tool including, without limitation, any liability for any direct, indirect, special, incidental, punitive and/or consequential damages (including loss of profits or principal).

No proprietary technology or asset allocation model is a guarantee against loss of principal. There can be no assurance that an investment strategy based on the tools will be successful.

This information should not be relied upon as research, investment advice or a recommendation regarding the Funds or any security in particular. This information is strictly for illustrative and educational purposes and is subject to change. This information does not represent the actual current, past or future holdings or portfolio of any Metaurus Advisors LLC client.

Prices are subject to change.

Commissions excluded.